colorado springs sales tax calculator

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. Manitou Springs is located within El Paso.

Sales Tax Information Colorado Springs

There is base sales tax by Colorado.

. Colorado Sales Tax. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535. 307 City of Colorado Springs self-collected 200 General.

The current total local sales tax rate in Colorado Springs CO is 8200. All numbers are rounded in the normal fashion. Sales Tax State Local Sales Tax on Food.

Calculator for Sales Tax in the Colorado Springs. The average cumulative sales tax rate in Manitou Springs Colorado is 903. Multiply the vehicle price.

This includes the rates on the state county city and special levels. The statewide sales tax in Colorado is just 290 lowest among states with a sales tax. Background - Understand the importance of properly completing the DR 0024.

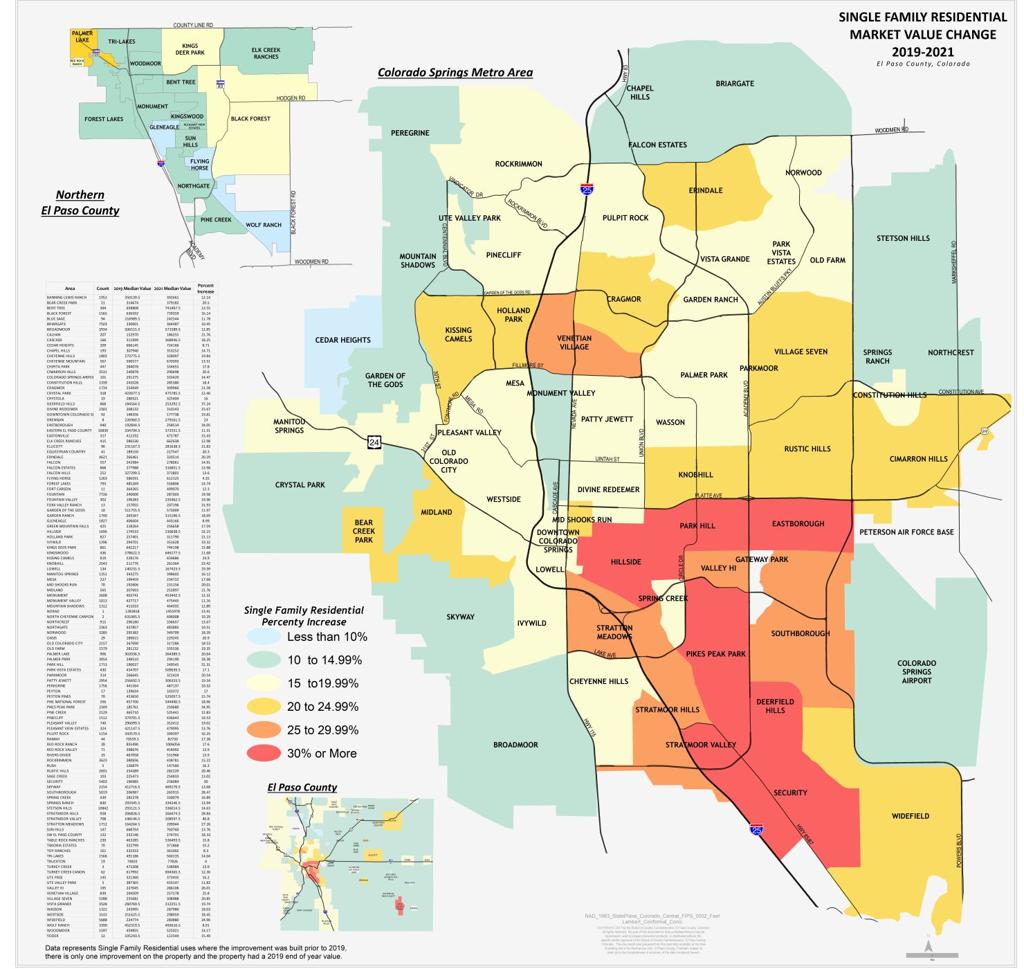

Rates are expressed in mills which are equal to 1 for every 1000 of property value. Ownership Tax Calculator Estimate ownership taxes. Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax.

Counties cities and districts impose their own local taxes. Avalara provides supported pre-built integration. How to Calculate Colorado Sales Tax on a Car.

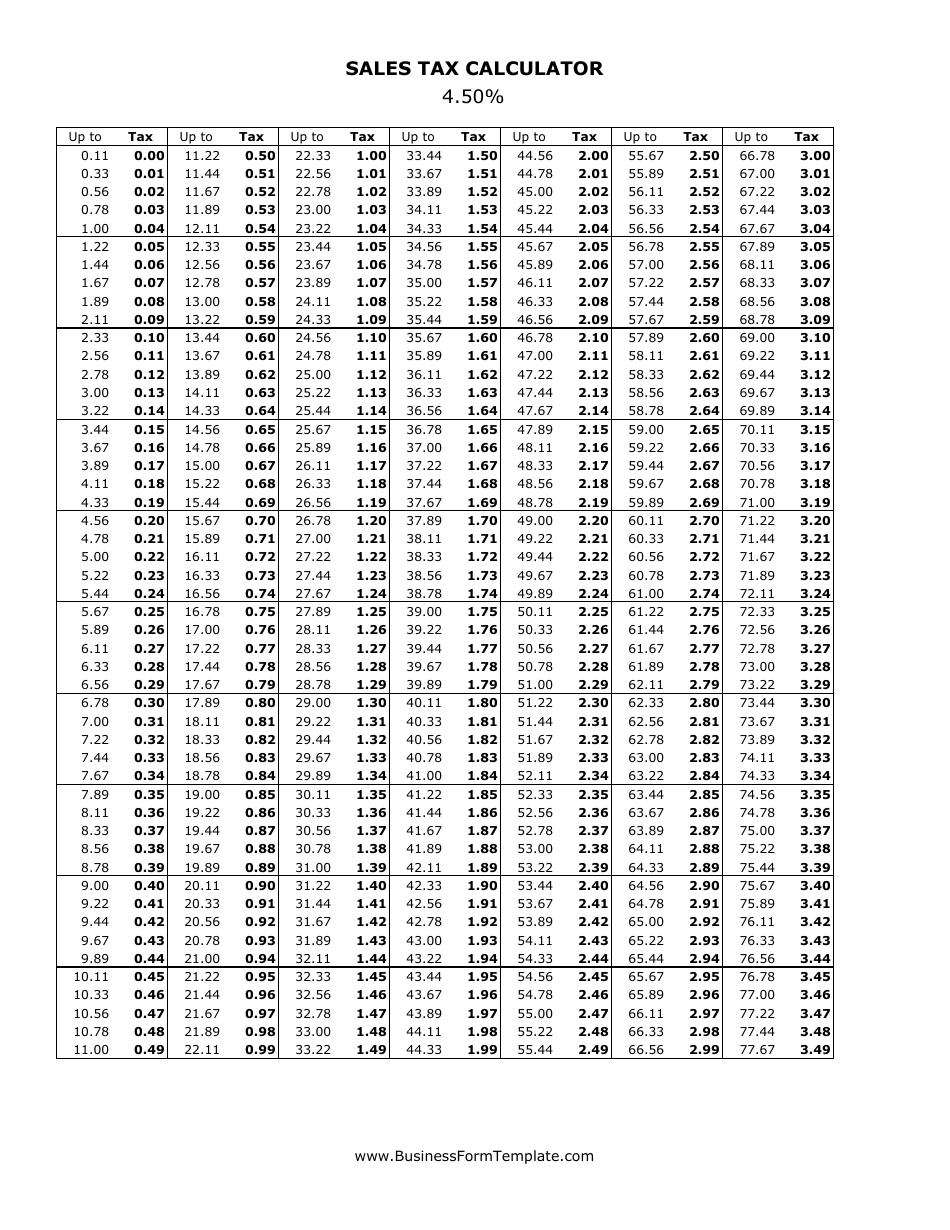

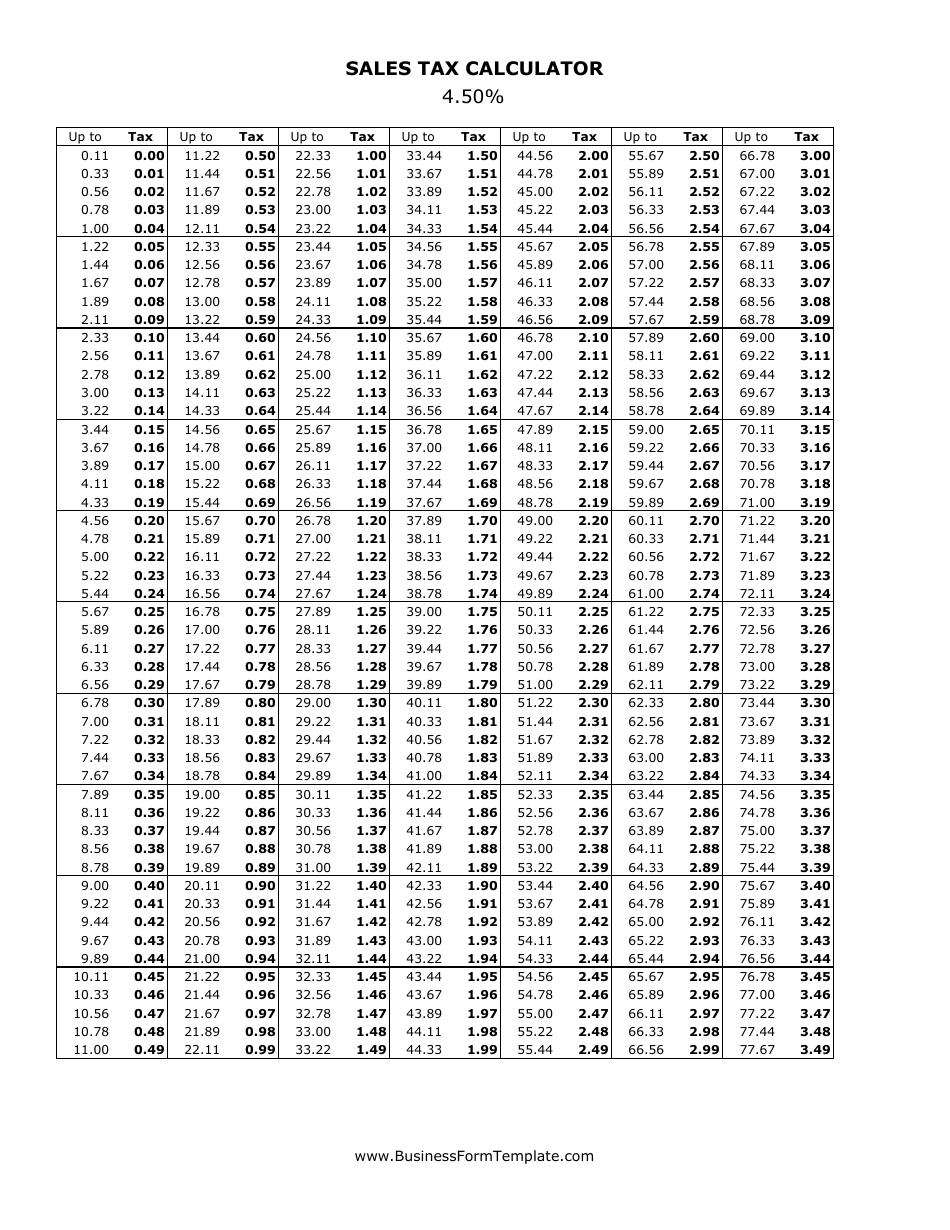

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 724 in Colorado Springs Colorado. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax Table For Colorado Springs Colorado.

Ad See how to streamline your sales tax filings and improve accuracy before annual reporting. The combined amount is 820 broken out as follows. The minimum is 29.

Method to calculate Colorado Springs sales tax in 2021. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. I report my gross and net taxable sales for my primary and subsidiary locations by using a schedule C when I file taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To cite an example the total sales tax charged for residents of. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax.

If you owe additional tax return the completed form and check. The December 2020 total local sales tax rate was 8250. What is the sales tax rate in Colorado Springs Colorado.

US Sales Tax Texas El Paso Sales Tax. You can print a 82. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following.

The GIS not only. This information is intended to provide basic guidelines regarding the collection of sales and use tax ownership tax and license fees. The combined rate used in this calculator 82 is the result.

Colorado has a 29 statewide sales tax rate but. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address.

Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. To calculate the sales tax amount for all other.

This site is now available for your review. The Colorado Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Colorado Springs Colorado in the USA using average Sales Tax. Welcome to the Sales and Use Tax Simplification SUTS Lookup Tool.

Visit the COVID-19 Sales Tax Relief web page for more information and filing instructions. US Sales Tax Colorado El Paso Sales. Calculator for Sales Tax in the Colorado Springs.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. Counties cities and districts impose their own local taxes. Real property tax on median.

However as anyone who has spent time in Denver Boulder or. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. There is base sales tax by Texas.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. This is the total of state county and city sales tax. Some cities in Colorado are in process signing up with the SUTS program.

Sales Tax Information Colorado Springs

Freebie How To Calculate Tax Tip And Sales Discount Cheat Sheet 7th Grade Math Sixth Grade Math Teaching Math

Sales Tax Information Colorado Springs

Wyoming Sales Tax Small Business Guide Truic

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

Colorado Springs Sales Tax Revenue Shows No Sign Of Slowing In March Subscriber Only Content Gazette Com

Bankerbhai Expense Inflation Calculator Investment Finance Homeloan Loan Personalloan Fridayfeeling Exitpol Business Tax Financial Planning Tax Prep

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

Colorado Springs Sales Tax Revenues Zoom To Record High In January Business Gazette Com

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

4 5 Sales Tax Calculator Download Printable Pdf Templateroller

Airbnb Rules In Colorado Airbnb Laws Taxes And Regulations The Leading All In One Vacation Rental Management Software For Pros Hostaway

Sales Tax Information Colorado Springs

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Property Tax Calculator Property Tax Guide Rethority

How To Calculate Cannabis Taxes At Your Dispensary

Printable Tax Prep Checklist Tax Prep Checklist Tax Prep Tax Checklist